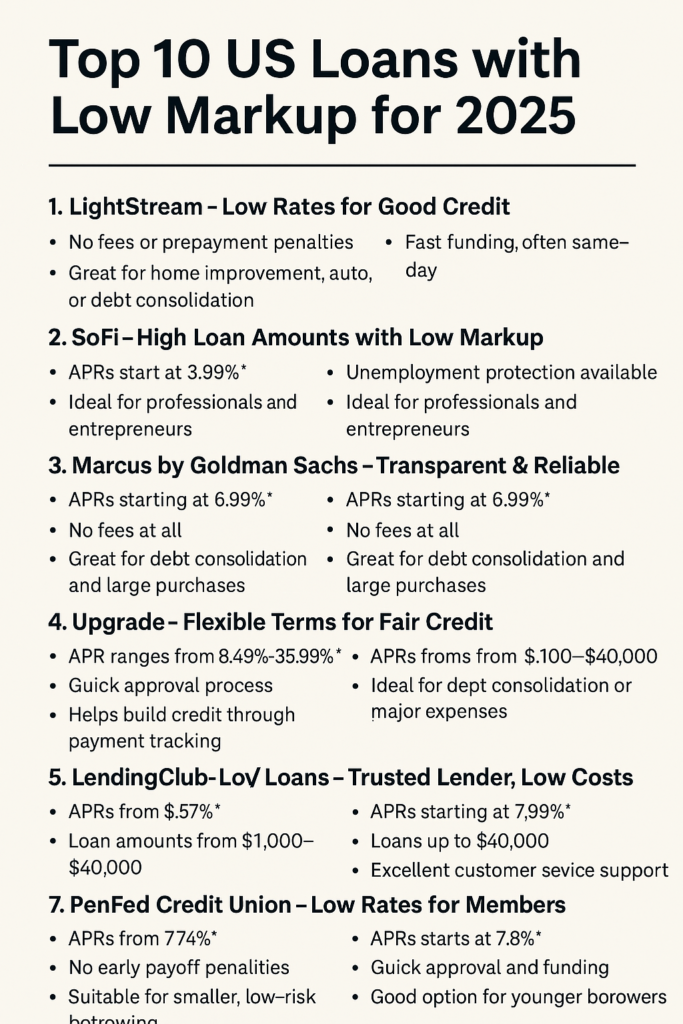

Top 10 US Loans with Low Markup for 2025

Looking for low-markup loans in the United States? Whether you’re building credit, consolidating debt, or starting a business, choosing the right lender is key. Here’s a carefully curated list of top US loans offering competitive rates and minimal markup.

1. LightStream – Low Rates for Good Credit

LightStream offers personal loans with some of the lowest APRs in the market. Borrowers with strong credit can enjoy rates starting as low as 7.49%*.

- No fees or prepayment penalties

- Fast funding, often same-day

- Great for home improvement, auto, or debt consolidation

2. SoFi – High Loan Amounts with Low Markup

SoFi stands out with zero fees and flexible loan terms. Borrow up to $100,000 with fixed low-interest rates.

- APRs start at 8.99%*

- Unemployment protection available

- Ideal for professionals and entrepreneurs

3. Marcus by Goldman Sachs – Transparent & Reliable

Marcus offers simple personal loans with fixed rates and no hidden fees. You can postpone a payment after 12 months of on-time payments.

- APRs starting at 6.99%*

- No fees at all

- Great for debt consolidation and large purchases

4. Upgrade – Flexible Terms for Fair Credit

Upgrade is ideal if you have fair credit and need fast access to funds. Offers fixed APRs and monthly payments.

- APR ranges from 8.49%–35.99%*

- Quick approval process

- Helps build credit through payment tracking

5. LendingClub – Low Markup Peer-to-Peer Loans

LendingClub connects borrowers with investors, allowing for competitive rates. A great option for personal or joint loans.

- APRs from 9.57%*

- Loan amounts from $1,000–$40,000

- Ideal for debt consolidation or major expenses

6. Discover Personal Loans – Trusted Lender, Low Costs

Discover provides fixed-rate personal loans with no origination fees. The lender also offers a 30-day return guarantee.

- APRs starting at 7.99%*

- Loans up to $40,000

- Excellent customer service support

7. PenFed Credit Union – Low Rates for Members

PenFed offers some of the best loan rates for credit union members. Even with average credit, you can access affordable financing.

- APRs from 7.74%*

- No early payoff penalties

- Suitable for smaller, low-risk borrowing

8. Upstart – AI-Powered Approval for Lower Rates

Upstart uses AI to assess credit risk, often offering better rates than traditional banks. Perfect for those with limited credit history.

- APR starts at 7.8%*

- Quick approval and funding

- Good option for younger borrowers

9. Best Egg – Fast Loans with Competitive APRs

Best Egg offers personal loans with a simple application process. Approved borrowers often receive funds within one day.

- APRs starting at 8.99%*

- Great for debt consolidation

- Fixed monthly payments and flexible terms

10. Avant – Reliable Option for Average Credit

Avant serves borrowers with credit scores starting around 580. It’s one of the few lenders offering competitive rates for lower credit profiles.

- APR ranges from 9.95%–35.99%*

- Funding in as little as 24 hours

- Helpful for emergency expenses

How to Choose the Right Low-Markup Loan

When selecting a loan, consider your credit score, income, and repayment ability. Compare interest rates, fees, and terms. Always read the fine print before signing.

Final Thoughts

Choosing a loan with low markup can save thousands over time. Each of the lenders listed above offers reliable, low-interest options tailored to different credit profiles. Evaluate your needs and pick the one that best fits your financial goals.